DeepenyourBondexpertisewithJiraaf’sone-stopanalyticalpowerhouse,designedtounlockinsightslikeneverbefore!

Our

Bond Analyser Suite

Bond Market Growth Trend

Indian Bond Market has grown ~7.5x in the last decade

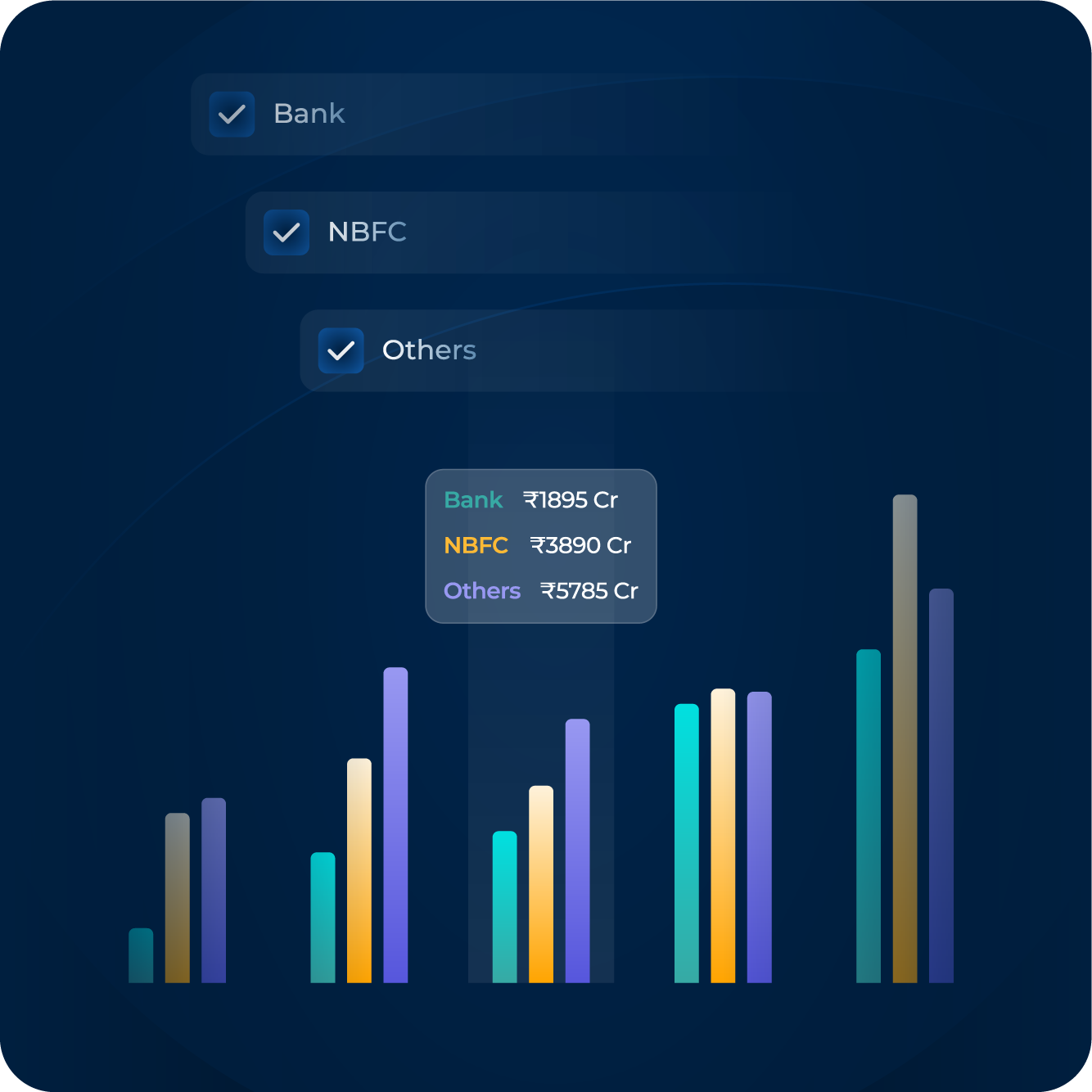

Bond Market Analysis

NBFC Issuances have grown 9x in 5 Years,

Hitting ₹3.2 Lakh Crore in 2024

Credit & Yield Analysis

5.5x growth in high yield investment grade bonds in last 3 years

Cracking the Bond Code

Smart Insights, Smarter Decisions

Tailored to the Indian Bond Market

Stay updated with current market trends and how they might impact your bond investments.

Backed by Market Data

Compare multiple bonds side-by-side or evaluate bonds against other investment opportunities.

Interactive Visual Analysis

Interactive charts and graphs to visualise bond performance, yield curves.

Macro and Micro Analytics

Cover the entire spectrum from broad market trends to specific bond insights.

Copyright © 2025, Jiraaf. All rights reserved.

Designed, Developed & Maintained by AI Growth Private Limited.