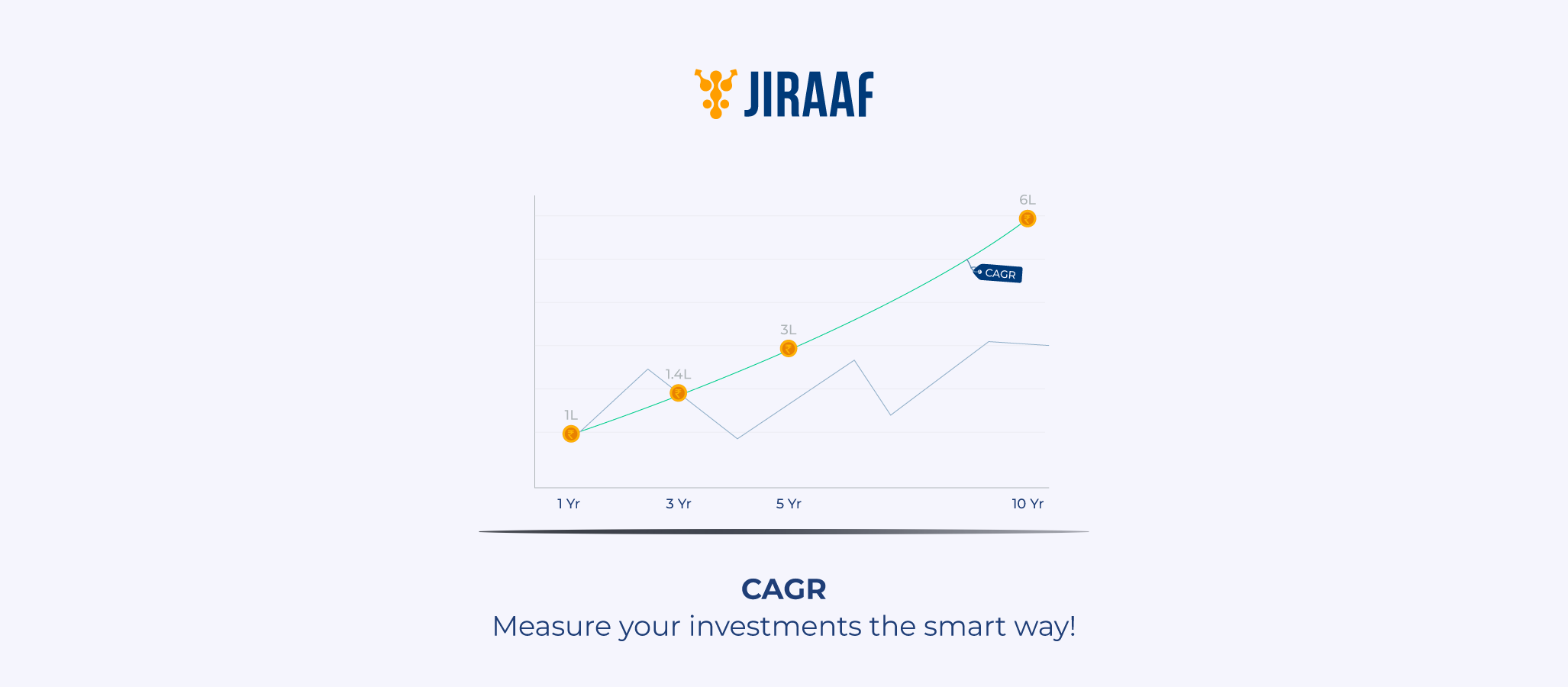

Absolute returns and compound annual growth rate (CAGR) are common phrases used when discussing mutual funds. While absolute returns show how much your investment grew overall. CAGR provides a more accurate picture of your fund’s annual growth rate, levelling out volatility.

But what precisely is CAGR, how is it calculated, and why is it relevant to mutual fund investing? Let us break it down.

What is CAGR in a Mutual Fund?

CAGR measures the average annual growth of a mutual fund investment over a period, assuming profits are reinvested. Unlike absolute returns, which reflect total growth, CAGR indicates how consistently your investment has grown year after year on a compounded basis.

Key features of CAGR

- Smooths out volatility: CAGR provides a consistent growth rate by smoothing out annual fluctuations.

- Easy to compare funds: Facilitates in fair and reasonable comparison of fund performance.

- Reflects the compounding effect: Demonstrates how reinvested returns increase long-term wealth.

Investing ₹1 lakh in a fund that grows to ₹2 lakh in five years results in a CAGR of 14.87%, indicating the annual growth.

How to Calculate CAGR in Mutual Fund

You can calculate the Compound Annual Growth Rate (CAGR) by following the below steps:

1) Determine the starting value (initial investment) and the ending value (the value after the chosen period).

2) Calculate the total number of years or periods during which the growth took place.

3) Use this formula: CAGR = (Ending Value / Beginning Value)^(1/Number of Years) – 1 or,

4. Lastly, to express the CAGR in percentage terms, multiply the value by 100.

Let’s understand this better with an example. Assume the following:

- Initial Investment (2019): ₹50,000

- Final Value (2024): ₹90,000

- Holding Period: 5 years

CAGR = ((90,000/50,000) ^1/5) −1

=12.47%

Pro Tip: Use a CAGR calculator (via SEBI-approved platforms) for smoother, quicker results.

Alternative Method: Using SEBI-Registered CAGR Calculators

Calculating CAGR manually might be time-consuming, particularly when you are comparing multiple mutual funds. Fortunately, SEBI-registered investing platforms and mutual fund websites provide free CAGR calculators to simplify the process. Here’s how to use them efficiently:

- Enter your initial investment (e.g., ₹50,000).

- To calculate the final value, add the current or purchased value (For example, ₹90,000 after 5 years).

- Select a duration – Determine the exact duration of your investment (years or months).

- When you click the “Calculate” button, the program calculates the CAGR immediately.

Using SEBI-registered calculators is a good option because they are more accurate, eliminating manual calculation errors. They use SEBI-compliant data; official NAV history for reliable answers, and they do come with some additional features like comparing CAGR across funds or adjusting for inflation.

CAGR vs Absolute Return: Key Differences

The following table summarizes the key differences between CAGR and Absolute returns:

| Characteristic | CAGR | Absolute Returns |

| Meaning | Shows the average annual growth | Shows the overall percentage growth |

| Formula | Compound growth formula | Simple percentage formula |

| Best For | Long-term investments | Short-term investments |

| Accuracy | More accurate over time | It may be misleading in the long term |

| Volatility | Doesn’t reflect fluctuations | Ignores changes in the market |

Real-World Example: Why CAGR Matters More for Long-Term Investors

Let’s compare two investors, X and Y, who each invested ₹5 lakhs in different mutual funds in the year 2020 for a 5-year period.

Investor X – Volatile Returns

X’s mutual fund experienced high ups and downs:

- Year 1: +25%

- Year 2: –10%

- Year 3: +35%

- Year 4: –5%

- Year 5: +20%

- Final Value: ₹8.25 lakhs

- Absolute Return: 65%

- CAGR: ~10.5%

Investor Y – Steady Returns

Y’s fund grew consistently at +12% every year:

- Year 1–5: +12% annually (compounded)

- Final Value: ₹8.81 lakhs

- Absolute Return: 76.2%

- CAGR: 12%

What This Example Shows

- Don’t Judge by Absolute Returns Alone

At first glance, X’s fund seems better with a 65% absolute return vs. Y’s 60%. But that’s misleading. CAGR shows that Y’s investment grew faster and more efficiently.

- CAGR Smoothens Volatility

X’s returns fluctuated wildly. Though the final value seems impressive, the inconsistent compounding reduced the overall growth rate. CAGR helps smooth out these ups and downs to give a more realistic picture of performance.

- Consistency Compounds Better

Y’s stable 12% return every year led to a higher final corpus (₹8.81L vs ₹8.25L), thanks to the power of steady compounding.

- CAGR Gives Long-Term Clarity

For long-term goals like retirement or children’s education, CAGR is a better metric to assess mutual fund performance – it reflects how consistently your money grows, beyond the noise of short-term swings.

Importance of CAGR in Mutual Fund Investment

The CAGR illustrates how compounding affects your investment returns. It helps you set realistic investment goals and track your progress towards them as well.

Here are some key reasons why assessing your mutual fund’s CAGR is important:

- It provides a consistent performance measure, making it easier to compare different mutual funds.

- It considers the compounding effect, which is important if you are a long-term investor.

- It provides a consistent depiction of the fund’s performance over time, especially in the face of short-term swings.

- CAGR is appropriate for analysing mutual fund performance over three or more years.

- It is especially useful for comparing funds with similar investment horizons.

- Investors can use CAGR to measure the overall growth of their portfolio over time.

Common Misconceptions and Assumptions

- As discussed above, CAGR is not same as average annual return. Two investments with same average annual returns may have different CAGR considering the compounding effect and longer duration.

- CAGR is not a guarantee to future performance. It is backward looking and if the future value of the investment drops, CAGR too will take a hit.

- CAGR does not consider the interim volatility that the investment faces.

- CAGR can be manipulated by selecting favourable time periods when the fund performed well.

Conclusion

CAGR is a helpful tool for navigating unpredictable markets and objectively evaluating mutual fund performance. Unlike absolute returns, which only show you the total growth, CAGR reveals your investment’s genuine annualized growth rate while considering compounding over time. Remember, CAGR is not perfect; it doesn’t account for short-term risks or promise future gains. For a more complete picture, integrate it with other indicators such as rolling returns, expense ratios, and risk-adjusted returns (Sharpe ratio). Whether you’re a first-time or seasoned investor, understanding CAGR helps you avoid deceptive returns and make data-driven decisions.

FAQs

What is the full form of CAGR in mutual funds?

CAGR stands for compound annual growth rate. It calculates the average annual growth rate of a mutual fund investment over a specified period of time, provided earnings are reinvested. Unlike basic returns, CAGR takes into account compounding effects, giving a more accurate picture of performance over the long run. It is reported as a percentage, allowing investors to compare funds objectively.

Why is CAGR significant in mutual fund investing?

CAGR reduces volatility and demonstrates constant annual growth, making it appropriate for long-term comparisons.

- It helps investors in determining genuine performance, avoiding short-term fluctuations.

- Establish reasonable expectations for goals such as retirement.

- Compare funds with varying tenures objectively.

Without CAGR, absolute gains can be deceptive over time.

How is CAGR calculated for mutual funds?

Use the formula: CAGR = (Ending Value / Beginning Value)^(1/Number of Years) – 1.

SEBI-registered CAGR calculators automate this for accuracy.

What’s the difference between CAGR and absolute returns?

Absolute returns measure the whole return on an investment, regardless of the period. CAGR, on the other hand, refers to the return on an investment over a certain time. Absolute returns and CAGR, both are used to calculate the returns on an investment.

How to compare mutual funds using CAGR?

CAGR is widely used to evaluate mutual funds returns. It assumes a steady rate of growth over a certain period, making it excellent for comparing funds with consistent investment patterns.

Discover fixed income investments with Jiraaf, a SEBI registered online bonds platform that educates and brings access to a wide array of bonds. Sign up today to explore diversified fixed income investment opportunities to support your goal-based wealth creation journey. Start investing!